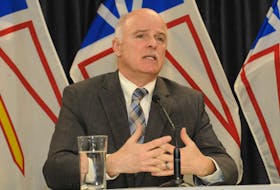

Finance Minister Tom Osborne isn’t too concerned about an initial review of the 2018 budget from credit rating agency Moody’s that highlights the risks of the province’s fiscal situation.

Moody’s released an initial assessment of the 2018 budget document on Wednesday, stating “the provinces faces increased risk that it will be unable to attain its goal of balanced budgets by 2022-23, a credit negative for the province.”

The credit rating agency currently rates the province at Aa3 negative —the lowest credit rating in the country, though still considered high-grade in the overall Moody’s credit rating system.

The ratings aren’t just for ranking — they dictate the cost of borrowing for the province. The province will spend just less than $1 billion on servicing its $$15-billion net debt in 2018.

The province has yet to meet with Moody’s, and the agency won’t issue an official ruling on the government’s credit rating until later this year.

Osborne, who spoke to reporters after addressing the St. John’s Board of Trade, says the path to surplus has ups and downs in the coming years, largely related to oil.

“In 2020 there’s a difference in revenue that’s directly related to the oil industry and some things that are happening in the oil industry at that time,” Osborne said.

“In regard to the amount of revenue we get, the amount of royalties, each project provides a different royalty. The following year, that gets back to normal.”

Moody’s points to the five-year plan as being much more ambitious in its last two years than in the first three, which means the plan “carries higher execution risk,” according to the agency.

Osborne says he understands Moody’s concerns, but he is confident the plan will work.

“Nobody’s saying this is easy. I see my role as being balanced. I’ve promised that right from the very first day I became minister of finance,” he said.

“We need to protect the economy, we need to stimulate the economy, we need to provide opportunity in the economy and this year’s budget was just as much about doing that as it was about retaining and attacking the fiscal crisis.”

Earlier this week DBRS, another credit rating agency, issued its own initial report that was a little more kind to the plan laid out by the government, but also identified plenty of risk that could throw things off course once again.

DBRS says the province’s economy is facing declining capital investment (largely due to the wind-up of the Muskrat Falls and Hebron construction projects), a weak labour market and an aging population.

While DBRS will also wait to meet with the province and analyze further before issuing an official update to the government’s credit rating, it noted an upgrade is unlikely in the near future.

Twitter: DavidMaherNL