By Swati Pandey

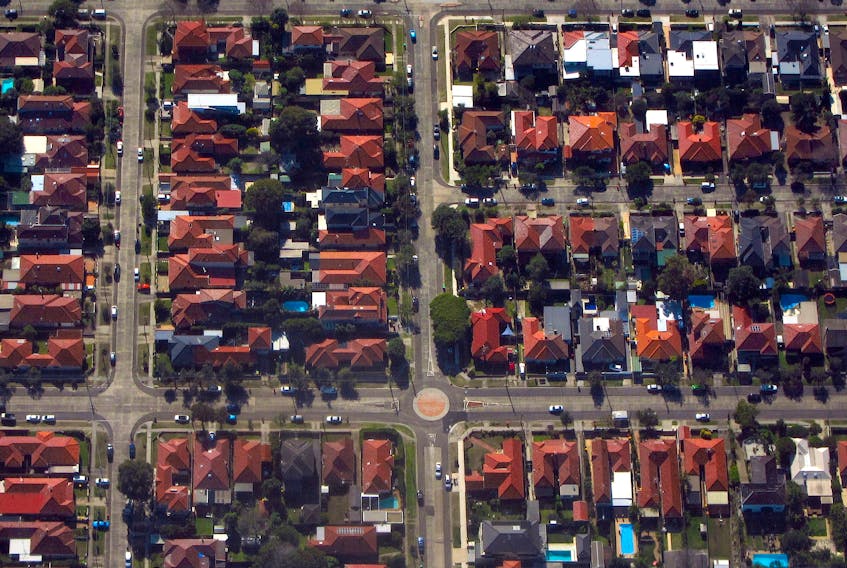

SYDNEY (Reuters) - Approvals for new home loans in Australia jumped for a second consecutive month in August, in a sign that recent rate cuts and easier lending rules were boosting the housing market though activity elsewhere in the economy remained subdued.

Home loans, a leading indicator for housing prices, showed a solid 3.2% gain in August to A$33.5 billion ($22.60 billion), Thursday's data from the Australian Bureau of Statistics (ABS) showed. Home loans had risen 5% in July.

Lending to property investors increased 6%, the largest increase since September 2016.

While upbeat housing activity is likely to boost consumer confidence, which hit a four-year low this month it will also revive concerns about frothiness and a debt binge in the property market when the rest of the economy is still struggling.

Australia's housing stock is valued at A$6.8 trillion ($4.83 trillion), or almost four times the country's annual gross domestic product.

"This reinforces our view of a mini-boom," in home prices and loans, said UBS economist George Tharenou.

Home prices enjoyed their biggest monthly jump in 2-1/2 years in September. Sydney and Melbourne prices climbed 1.7%, a rate of increase reminiscent of the bubble days of 2016.

"If loans and prices surprisingly continued to boom, it would...raise the risk it stops the RBA from easing next year," added Tharenou, who expects further rate cuts by mid-2020.

The Reserve Bank of Australia (RBA) reduced its benchmark rate to a record low of 0.75% last week following two back-to-back easings in June and July to revive economic growth, employment and inflation.

Governor Philip Lowe has signaled the central bank would do more if needed while also underlining the importance of fiscal stimulus and structural reforms to boost medium-to-long term growth.

Financial futures <0#YIB:> are pricing in a 50-50 chance of a fourth rate cut to 0.5% next month as a fiscal boost to revive the economy is regarded as unlikely anytime soon.

Prime Minister Scott Morrison's conservative government is more inclined to meet an election promise to return the budget to surplus this year.

State treasurers are expected to press Federal treasurer Josh Frydenberg to bring forward infrastructure spending when they meet on Friday.

The rate cuts have so far done little to revive broader economic activity.

Personal finance commitments fell 2.2% in August followed by a 3.8% drop in July, the figures showed. Lending to businesses, which includes commercial as well as lease finance, slipped 2.1% and was down more than 6% from a year ago.

"This supports concerns that the RBA's rate cuts are flowing through more intensely into housing compared with other key parts of the economy, including household consumption and businesses," ANZ economists wrote in a note.

"While we believe we’re currently seeing a pop rather than the beginning of a v-shaped recovery in the housing market, the increases in prices and mortgage demand are likely to be a concern for the RBA, particularly given record high household debt."

(Reporting by Swati Pandey; Editing by Kim Coghill & Simon Cameron-Moore)